· I'mBoard Team · governance · 10 min read

Corporate Governance Examples for Startup Success

Stage-fit corporate governance examples that speed decisions for Seed → Series B CEOs. Templates, agendas, and checklist to move faster.

Corporate governance examples for startups by stage

Corporate governance examples provide strategic frameworks for startups to establish effective leadership, decision-making processes, and accountability at different growth stages. These examples help founders create structured board interactions, align investor and management interests, and build robust organizational oversight that supports sustainable growth and investor confidence.

I’m Mark Davis — I’ve sat on both sides of the board table as a founder and an investor. These corporate governance examples show how startups can govern effectively at Seed, Series A, and Series B to speed decisions, preserve runway, and stay focused on growth. If you’re scaling with limited time and headcount, follow the stage-fit patterns below (Seed → Series B) and avoid turning your board into a slide theater. The gap between speed and stall isn’t about policy thickness — it’s about clarity, cadence, and the right artifacts at the right stage. The best governance is small-batch, decision-first, and async-friendly.

Seed: minimum viable board, cadence, policies, and charter

Composition: 2 founders + 1 investor or seasoned operator; a one-page board charter clarifies purpose, cadence, and consent list. Keep the board under five people to preserve candor and speed.

Cadence: monthly 60–90 minute meetings while runway is under 12–18 months; otherwise move to quarterly. Seed pre-reads are shorter (48 hours before) and capped around 12–15 slides.

Agenda (60–90 minutes):

- 10 min: headlines (what changed)

- 15 min: top metrics (growth, churn, cash)

- 20 min: decisions (3–5 motions)

- 10 min: top risks (risk register)

- 20 min: targeted deep dive

Policies: include a one-page code of conduct, anti-harassment, basic data retention, and D&O insurance if you have outside directors. Use consent resolutions for routine approvals to save live time.

Tools: use a 2x2 Decision Priority Matrix and RAPID decision rights; name the Decider (D) for every motion in the pre-read. Consider centralizing agendas, consent queues, and minutes with a tool like ImBoard.ai to streamline the workflow. For example, a Seed devtools CEO moved hiring and vendor approvals to consent resolutions and halved time-to-decision while shortening meetings to 75 minutes. See related templates in our guide: board meeting templates and startup governance guide.

Artifacts: a Seed board charter, a lightweight agenda template, and a consent-resolution approach to routine approvals.

Series A: add independence, tighter reporting, and risk reviews

Composition: add one independent director with operational experience (e.g., CRO for GTM or CFO for finance). Investors increasingly expect an independent at Series A.

Cadence: quarterly full-board meetings, with a monthly metrics email and a mid-quarter working session as needed. Pre-reads should be sent 3–5 days in advance.

Upgrades:

- Formal risk register reviewed quarterly that includes security, churn concentration, and vendor dependency.

- KPI dashboard focused on NRR, CAC payback, burn multiple, and gross margin with trend lines (not just snapshots).

- Expanded policies to include anti-bribery, an expense policy, and an approvals matrix.

Best practice: flag reversible vs irreversible decisions and include a kill-switch date in motions to avoid zombie projects. Example: a Series A SaaS firm made NRR and CAC payback the D-1 agenda items, killed underperforming channels, and reallocated spend to improve growth without increasing burn.

Series B: committees, KPI depth, audit readiness

Composition: establish formal committees (Audit, Compensation) with charters; include an independent director with finance expertise. Committees should have clear, written decision rights.

Cadence: maintain quarterly board meetings with committee meetings scheduled before the full board; pre-reads 5–7 days ahead.

Focus areas:

- Increase KPI depth: cohort retention, margin by product, sales ramp, and hiring funnel velocity.

- Strengthen controls: revenue recognition checks, SOC 2/ISO path, and quarterly control sampling.

- Use committees to propose and the board to approve for crisp decision rights.

Example: a Series B infra company formed an Audit Committee and used a 10-point quarter-close checklist; close quality improved and lenders reduced covenant scrutiny.

Which artifacts can you ship this week?

You can accelerate governance setup by shipping five artifacts in 48 hours. Each document should be one page or a clear template.

- One-page board charter and social contract.

- Decision docket template: motion, Decider (RAPID D), options, success metric, deadline.

- Consent resolution template for routine approvals.

- Risk register with owner, likelihood, impact, and next action.

- Board minutes template that lists motions, owners, and due dates.

Shipping these reduces friction and creates an audit trail for decisions and follow-ups. The real fix isn’t endless policy—it’s a predictable rhythm and named owners.

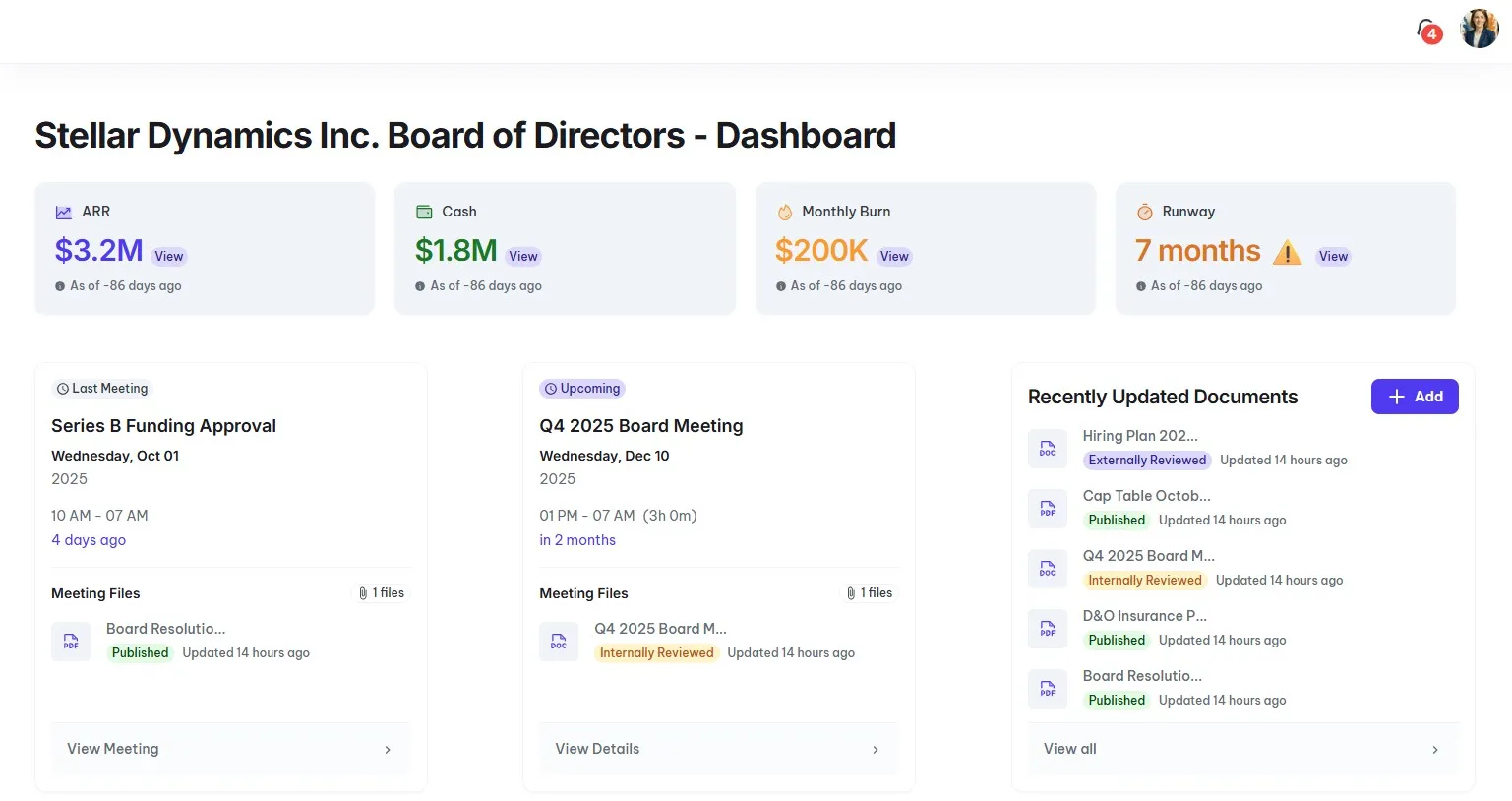

Which KPIs should live in your board dashboard?

Boards need a compact set of vital metrics with thresholds and trend context.

- ARR and growth rate

- NRR/GRR with cohort views

- CAC payback and burn multiple

- Gross margin and runway

- Qualified pipeline and win rate

- Hiring plan vs actual and engineering throughput

Use sparklines, RYG thresholds, and label “Decision Needed” directly on the dashboard. Refresh the dashboard weekly so directors can act async. Example thresholds (heuristics): burn multiple target < 1.5, CAC payback < 12 months for core segments, trigger plan review at runway < 12 months.

How do you run meetings so they actually move work forward?

For more insights on this topic, see our guide on The Complete Guide to Board Meeting Minutes Best Practices.

Operational cadence and async workflows save hours and reduce meeting churn.

- Define a monthly/quarterly backbone with concrete dates for metrics distribution, pre-reads, and meetings.

- Require pre-reads 3–5 business days before meetings for most stages; Seed exceptions of 48 hours are allowed when runway urgency demands it.

- Run a consents queue with a 72-hour SLA for routine approvals and track Q&A in-line in your portal.

Operational tip: include a “consents queue” in every pack so directors can pre-commit and speed votes. A disciplined consent process can cut live meeting approval time substantially.

What do investors expect at each stage?

Investors scan governance artifacts to judge execution speed and risk control.

- Seed: a functioning board (not a WhatsApp thread), concise agendas, a KPI dashboard with runway, code of conduct, and D&O insurance.

- Series A: a plan for an independent director, monthly metrics, a risk register, and an approvals matrix.

- Series B: committee charters, audit readiness, cohort-level KPIs, and clean minutes with decision logs.

VCs commonly review recent minutes during diligence; motions that linger across multiple meetings signal execution drag to investors.

How do you set the founder–board social contract?

Put a one-page social contract on page two of your next pack and close it with a consent resolution to formalize expectations.

- No surprises: material changes signaled within 48 hours with a plan.

- Prep discipline: pre-reads 5 business days ahead for most stages; directors comment inline 24 hours prior.

- Clarity: every meeting ends with motions, owners, and due dates in the minutes.

- Candor and time respect: limit observers, CEO controls the agenda, operational feedback is taken offline.

- Annual composition review and skills matrix to close gaps.

Operationalize now: add the social contract to your ne

For more insights on this topic, see our guide on Better Limited Liability Company Agreement Template Starts Here.

xt pack, attach the decision docket, and hold a 15-minute retro at the end of each board to close the loop.

Quick checklist: avoid the most common pitfalls

- Don’t make meetings status dumps: aim for 20% reporting and 80% decisions and risk management.

- Cap observers: more than two external observers dilutes candor.

- Log motions within 24 hours to maintain a decision trail and avoid theater.

- Name Deciders and set kill dates in pre-reads to prevent zombie work.

Mini-cases (anonymized): reducing observers from 11 to 5 stabilized NRR after contract restructures; adding an independent CRO at Series A killed poor channels and accelerated growth; a Series B Audit Committee improved close quality and eased lender oversight.

Part of our Startup Governance Guide — A comprehensive resource on corporate governance for startups.

Frequently Asked Questions

Q: How often should startup boards meet? A: Most startup boards meet quarterly. Many early-stage companies increase cadence to monthly when runway is under 12–18 months to speed decisions. Schedule meetings at least six months in advance and use a short monthly metrics email between full meetings to prevent information gaps.

Q: What is the minimum viable board for a Seed startup? A: The minimum viable board for a Seed startup is typically 3 members: 2 founders and 1 investor or seasoned operator. Keep the board under five members to preserve candor and speed; document a one-page charter that defines cadence, consent approvals, and the Decider for motions. Use consent resolutions to move routine approvals without live discussion.

Q: What should be in a board pre-read to get alignment fast? A: Start the pre-read with a one-page cover memo that states the motion, recommended Decider, deadline, and success metric. Follow with a two-page KPI snapshot and a one-page risk update; cap total pre-reads at 12–15 slides for Seed packs. Sending pre-reads 3–5 business days in advance and highlighting “Decisions Needed” in-line improves director preparation.

Q: How do I handle a disagreement between founders and an investor on a key decision? A: Start with a direct vote on the motion after a short, evidence-based discussion and document the outcome in minutes within 24 hours. Escalate via a defined escalation path in your charter (e.g., CEO mediation, independent director review, or an advisory committee) and set a 30–90 day kill date for reversible options. Use this structure to avoid stalled execution and provide a clear fallback for lenders or future investors.

Q: Which KPIs should be non-negotiable on a SaaS board dashboard? A: Non-negotiable SaaS KPIs include ARR, NRR with cohort trends, CAC payback, burn multiple, and runway. Use cohort-level NRR to detect early retention issues. Targets such as CAC payback < 12 months and burn multiple < 1.5 are common investor heuristics; treat them as benchmarks to trigger plan reviews rather than absolute rules.

Q: How should a company prepare for audit readiness at Series B? A: Begin audit readiness by creating an audit checklist and assigning an Audit Committee lead at Series B; implement quarterly control sampling and a 10-point quarter-close checklist. Target SOC 2 readin

For more insights on this topic, see our guide on The D&o Insurance For Startups Myth Thats Costing You.

ess and revenue recognition checks six to nine months before formal needs; document control owners and remediation deadlines in the risk register.

Glossary

- Fiduciary Duty: The legal obligation of board members to act in the best interests of the company and its shareholders, placing those interests above personal gain.

- RAPID: A decision-making framework (Recommend, Agree, Perform, Input, Decide) that assigns clear roles to speed decisions and avoid ambiguity in board motions.

- Consent Resolution: A written board approval process for routine, non-controversial actions that can be passed without full-board discussion, often with a set voting SLA (e.g., 72 hours).

- NRR (Net Revenue Retention): A percentage metric that measures revenue expansion and churn within an existing customer base over a specified cohort period, used to signal product-market fit and expansion health.

- Burn Multiple: A ratio of net new ARR to cash burned over a given period; commonly used as an efficiency benchmark (heuristic targets include <1.5 for efficient growth).

- SOC 2: A common security compliance framework focused on controls for security, availability, processing integrity, confidentiality, and privacy; often required for enterprise sales and Series B+ diligence.