· Mark Davis · governance · 9 min read

Board meeting: practical governance for startups

A pragmatic, operator-first approach to board meetings that demystifies governance, trims fluff, and drives accountability with concrete examples and runnable actions.

A pragmatic, operator-first approach to governance starts with clarity, not fluff. For startups, a well-run board meeting is less about optics and more about accountability, rapid learning, and concrete next steps. This guide offers a practical playbook to demystify governance, trim excess, and drive measurable progress with runnable actions, real templates, and lean reporting.

What a board meeting is and why it matters

A board meeting is the formal cadence where founders, the CEO, the board chair, and investors align on strategy, risk, and performance. It isn’t just a ritual; it’s the governance engine that keeps a startup moving with discipline. When done well, a board meeting surfaces critical decisions, clarifies ownership, and creates a documented trail of accountability that founders and investors can trust.

In startup governance, the board’s role is to provide perspective, guardrails, and rigorous decision rights. The leadership team communicates progress and risk, while the board critiques plans, approves bets, and ensures compliance with applicable laws and governance norms. The right cadence and artifacts turn this relationship into a powerful accelerant rather than a bottleneck.

Key distinction to keep in mind: board vs. leadership roles. The CEO and executive team run the company daily and own execution, while the board sets strategic direction, monitors risk, and approves major commitments. Clarity here reduces friction and accelerates decision-making in fast-moving environments.

As you design your board process, remember: the goal is not to produce more meetings, but to drive better outcomes. That means crisp agendas, timeboxed conversations, and a decision log that makes choices explicit and traceable.

People also ask: What should be included in a startup board meeting agenda? How often should a startup board meet and why? What makes board minutes useful for founders? The answers are embedded throughout this guide, with concrete examples you can adopt today.

Preparation that pays: agendas, pre-reads, and roles

Preparation is the secret sauce. A great board meeting starts before the calendar invite goes out. It hinges on a clean agenda, bite-sized pre-reads, and clear role definitions that ensure the right people contribute to the right decisions.

Agenda design that drives decisions

Structure the agenda around decision points, not status updates. A typical agenda might include:

- Opening and governance reminders (5 minutes)

- Strategy and bets (15–20 minutes)

- Key metrics and dashboards (15 minutes)

- Risks, issues, and compliance (10–15 minutes)

- Major decisions and approvals (15–20 minutes)

- Conclusion and action items (5 minutes)

Keep timeboxing strict. If a topic needs more discussion, assign owners to prepare a deeper briefing outside the meeting or schedule an executive session with the board chair and CEO.

Pre-reads that are worth the time

Pre-reads should be concise, scannable, and actionable. For each briefing document, include:

- One-page summary with 3–5 bullet points of what changed and what’s at stake

- Key metrics with visual cues (sparklines, traffic light status) and a brief interpretation

- Decisions requested and alternatives considered

- Risks, dependencies, and mitigations

- Questions for the board and any required approvals

Distribute pre-reads at least 48 hours in advance to give directors time to prepare. Consider a brief executive summary video for high-stakes topics to save time in the meeting itself.

Roles that keep the meeting tight

Clearly defined roles reduce noise and accelerate decisions:

- Board chair: leads the meeting, ensures governance discipline, protects time, and drives decisions to closure.

- CEO: presents the business case, answers questions, and coordinates follow-through.

- Secretary or scribe: records decisions, assigns owners, and tracks action items in the decision log.

- Participants: come prepared with questions, focus on risk and strategy, not daily tasks.

Use a board portal to distribute materials, host the agenda, and store the decision log. A consistent platform streamlines preparation and post-meeting follow-through.

Run a productive meeting: cadence, timeboxing, and decision records

Delivery matters as much as content. A well-run board meeting respects time, surfaces decisions, and produces actionable follow-through.

Cadence that matches startup reality

Most startups benefit from a quarterly board meeting cadence, with monthly or bimonthly updates to keep risk in view and avoid surprises. In early-stage startups, adding a brief monthly update focused on milestones, burn, and hiring may help keep investors informed without overburdening the board. The right cadence is one that supports timely decisions without creating bureaucratic overhead.

Timeboxing and decision records

Timebox each agenda item and make decisions explicit. For example:

- Decision: Approve Series A fundraising plan, including target amount and use of proceeds (Owner: CEO).

- Acceptance criteria: At least two term sheets received; projected runway remains ≥ 12 months post-close.

- Next steps: Legal review; finalize term sheet with lead investor by end of week.

Every decision should be logged in a decision log, which serves as the living record of governance. A well-maintained log aids accountability, simplifies board minutes, and provides a reference during audits or revisions.

Dashboards and KPI visuals that tell a story

Board members rely on dashboards to understand performance quickly. Use visuals that are intuitive and decision-focused:

- Cash runway and burn, with scenario-based projections

- Customer acquisition cost (CAC) and lifetime value (LTV) trends

- Revenue trajectory, ARR growth, and renewal rates

- Product milestones, timing, and risk indicators

Pair dashboards with a concise commentary that interprets the data. If a metric is off plan, frame the implications and the proposed mitigation, not just the numbers.

Templates: agenda, minutes, and decision log

Adopt simple templates that you can reuse every cycle. Examples to consider integrating into your templates, and linking to in your internal resources, include:

- Board meeting agenda template

- Board meeting minutes template

- Decision log template

These templates create consistency and speed up the governance process. For quick access, link these templates in your board portal and reference them during onboarding of new directors or executives.

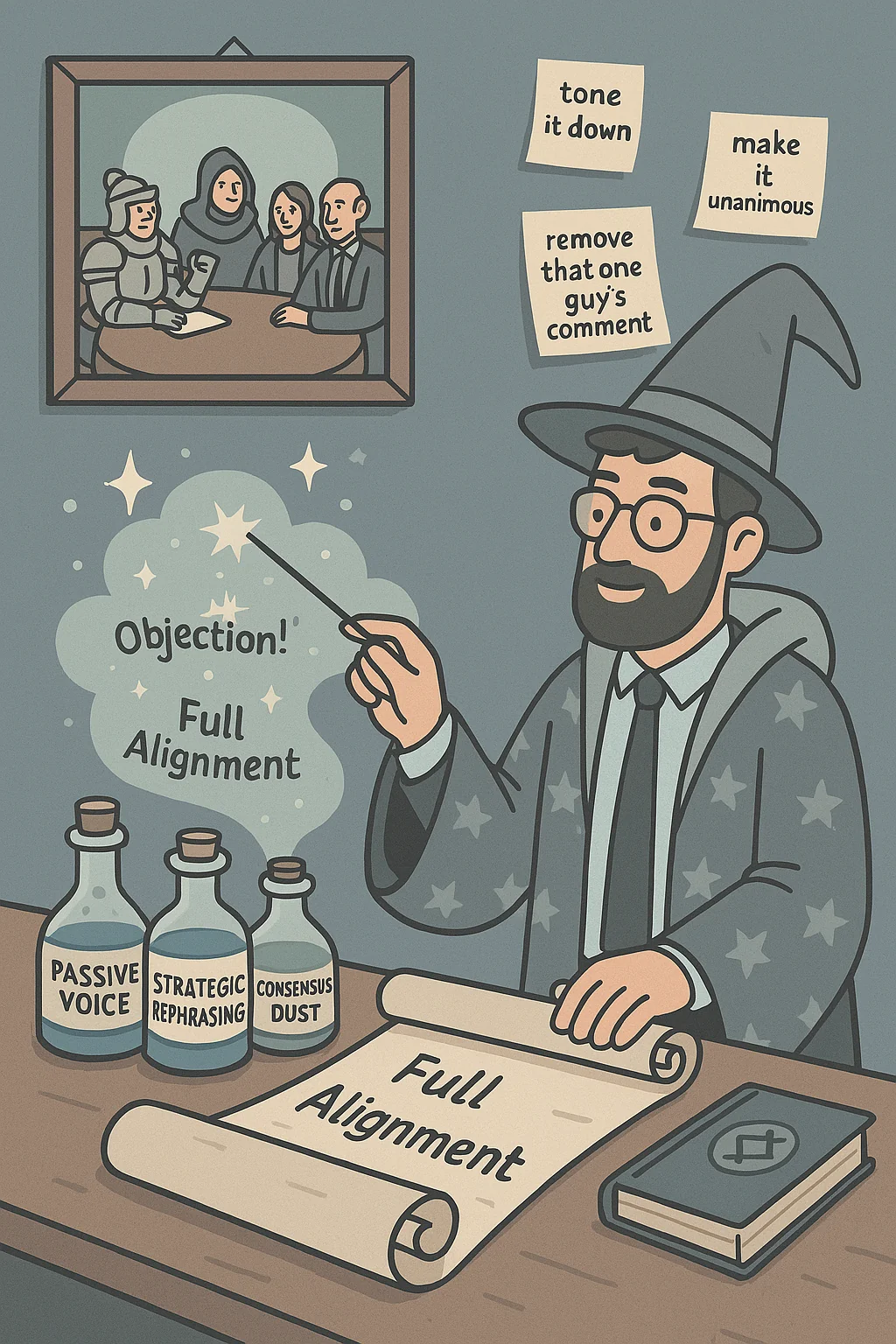

Common board issues in startups and how to address them

Boards often encounter recurring patterns. Proactively addressing these issues reduces friction and improves governance outcomes without adding fluff.

Misalignment on strategic bets

Symptom: The board questions the feasibility of a major pivot or deprioritizes a key initiative. Cause: unclear strategy articulation or diverging risk tolerance between founders and investors.

Fix: Prepare a decision packet that outlines three scenarios (base, downside, upside) with quantified risks and required approvals. Use a decision log entry to capture the chosen scenario and the justification.

Unclear decision rights and role friction

Symptom: Duplicate veto power, unclear authority to approve spending, or conflicting expectations about hiring decisions.

Fix: Revisit governance scope and publish a simple RACI (Responsible, Accountable, Consulted, Informed) for major decisions. Align board and leadership on who approves what, and document it in the board portal.

Inadequate risk management and compliance basics

Symptom: Untested risk scenarios, poor data handling, or lagging compliance oversight.

Fix: Introduce a lightweight risk register and an annual compliance checklist. Use dashboards to monitor high-priority risks and flag items for the board to review in each meeting.

Meeting fatigue and low signal meetings

Symptom: Long meetings with minimal actionable outcomes, or topics that fail to capture real risk.

Fix: Reduce meeting length by pruning non-critical updates. Move tactical operational reports to a separate quarterly cadence. Use the decision log to close topics and track accountable owners for actions.

Poor minutes and lack of accountability

Symptom: Vague notes, no owners, no next steps, and unclear decisions.

Fix: Publish minutes immediately after the meeting with explicit decisions, owners, and due dates. Refer to the minutes in follow-up communications and link to the decision log for auditability.

Post-meeting follow-through: metrics, accountability, and next steps

Post-meeting discipline is where governance proves its value. The real work begins after the gavel. This is how you close the loop and keep momentum without drifting into fluff.

Translate decisions into action

Assign owners, deadlines, and measurable outcomes for every decision. Create a lightweight action tracker and sync it with the board portal so stakeholders have visibility. At the next meeting, review the status of each action item and adjust priorities as needed.

Close the loop with metrics and dashboards

Update dashboards with the latest data and attach a short narrative explaining deviations and corrective steps. Use a consistent format so directors can compare performance across cycles and track improvement over time.

Orchestrate accountability with the decision log

The decision log is the backbone of governance. Each entry should include:

- Decision and rationale

- Owner responsible for execution

- Deadlines and success criteria

- References to supporting documents and pre-read materials

Review the decision log at every meeting to confirm progress and adjust plans if necessary. This habit dramatically increases accountability and reduces ambiguity for founders and investors alike.

Internal links to practical resources

- For a ready-to-use framework, leverage the Board meeting agenda template to standardize your prep process.

- When minutes need to be precise and usable, use the Board meeting minutes template and ensure every decision is traceable.

- To elevate governance dashboards, consult our guide on KPI dashboards for boards and tailor visuals for strategic decision-making.

Pair these templates with a robust board portal to centralize materials, track actions, and maintain version history. A portal keeps the board and leadership aligned between meetings and speeds up onboarding for new directors.

External perspective and benchmarks

External governance insights can help ground your expectations. For example, governance best practices emphasize clarity in decision rights, transparency in reporting, and consistent risk oversight. See industry benchmarks and best-practice guidance for governance effectiveness and board performance at ICGG – Governance Best Practices for context on board effectiveness and governance practices.

Putting it all together: a practical, no-fluff playbook

To implement this approach in your startup, start with a lightweight pilot. Choose a quarterly board meeting cadence, implement a crisp agenda with timeboxed topics, deploy a decision log, and circulate concise pre-reads. Use KPI dashboards that clearly illustrate risk and progress, and keep the post-meeting actions tightly tracked with owners and deadlines.

As you scale, you can expand on the basics without sacrificing simplicity. Integrate the templates into your standard operating rhythm, invest in a reliable board portal, and maintain a culture of direct, data-driven governance. The goal is not to overcomplicate governance but to make it a practical, repeatable mechanism that helps founders move faster while maintaining accountability and compliance.

People also ask - embedded responses

What should be included in a startup board meeting agenda?

Include a concise opening on governance reminders, a strategic bets section, a metrics dashboard, risk and compliance topics, major decisions, and a clear set of action items with owners. Keep it timeboxed and focused on decisions rather than routine updates.

How often should a startup board meet and why?

Quarterly meetings are common to balance strategic oversight with operational agility. Monthly executive summaries or updates can help keep risk in view, but avoid creating meeting fatigue. The cadence should align with your decision cycles and funding milestones.

What makes board minutes useful for founders?

Effective minutes capture decisions, rationale, owners, and deadlines. They provide a transparent record for accountability and serve as a reference during funding rounds, audits, and governance reviews. Consistent minutes reduce ambiguity and accelerate follow-through.

Primary keyword usage: board meeting. The term appears naturally throughout this guide to reinforce relevance for search and readers alike. The content integrates the concept into governance best practices, actionable steps, and practical templates to empower startup leadership with real, runnable outcomes.